In 2025, the e-commerce industry continues to grow rapidly, and Dropshipping and Print on Demand (POD) are two of the most popular business models. Many entrepreneurs often find themselves torn between the two when deciding which type of e-commerce store to start. So, what are the key differences? Which model is better for you? In this article, we will thoroughly compare these two business models, discuss their pros and cons, and help you make a well-informed decision.

What is Dropshipping?

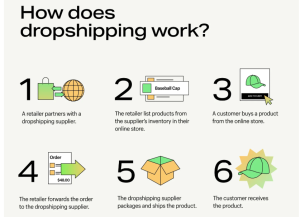

Dropshipping is an e-commerce business model. The retailer doesn’t keep inventory. Instead, they team up with a supplier. When an order comes in, the supplier ships the products straight to the customers. In this model, the retailer focuses on sales and marketing while the supplier takes care of product manufacturing, inventory management, and shipping.

For more details on dropshipping, check out our previous article on What is Dropshipping & How to Start.

What is Print on Demand?

Print on Demand (POD) is a custom e-commerce model where the retailer does not need to purchase large amounts of inventory upfront. Instead, products are printed and produced only when a customer places an order. This model is often used for custom items like T-shirts, mugs, posters, and more. It allows retailers to offer unique and personalized products without the need for upfront inventory investment.

For more detailed information on Print on Demand, refer to our earlier article on What is Print on Demand? A Beginner’s Guide to the Growing?.

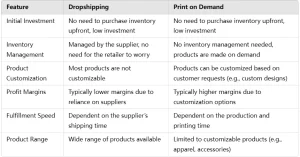

Dropshipping vs Print on Demand: A Comparative Analysis

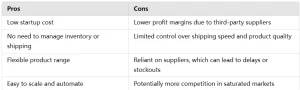

Dropshipping Pros & Cons

Print on Demand Pros & Cons

Dropshipping vs Print on Demand: A Comparative Analysis

Which One Should I Choose?

Instead of choosing between dropshipping and print on demand, the goal of this article is to help you gain a deeper understanding of both business models. By reading this guide, you should be able to make an informed decision about which industry or service is the best fit for you. Both models have their unique advantages, and your decision should be based on your business goals, target market, and product offerings.

Conclusion

As we discussed in the Dropshipping Pros section, services like DropSure can help streamline and enhance the dropshipping process. We encourage you to explore your options carefully and choose the model that aligns with your business vision and resources.

3 min read

3 min read