In today’s hyper-competitive ecommerce landscape, success rarely comes from selling what everyone else is selling.

The era of “general stores” and copy-paste winning products is over. Ad costs are rising, marketplaces are crowded, and consumers are more selective than ever. If you’re entering a market late—or without differentiation—you’re fighting an uphill battle from day one.

That’s why the smartest sellers, brands, and product teams are shifting their focus to niche markets.

But niche doesn’t mean small.

And it definitely doesn’t mean guessing.

This article breaks down how to use product research tools to systematically identify the five least competitive vertical markets, using data—not hype, not intuition, and not luck.

What Is a Niche Market (Really)?

Let’s clear up a common misconception.

A niche market is not:

-

A low-volume product

-

A weird or novelty item

-

A product with no competition

-

A one-time trend

A true niche market is:

-

A specific group of users

-

With a clearly defined problem

-

Actively searching for solutions

-

Underserved by existing products or brands

Competition doesn’t disappear in niches—it becomes inefficient.

And inefficiency is where opportunity lives.

Why Most Sellers Fail at Niche Market Research

Before we talk about tools, we need to talk about mistakes.

Most sellers fail at niche research because they:

-

Start with products instead of problems

-

Rely on surface-level metrics (volume only)

-

Confuse low competition with low demand

-

Use tools passively instead of strategically

-

Look for “proof” instead of probability

Niche discovery is not about finding something perfect.

It’s about finding something unbalanced—where demand outpaces supply quality.

Why Product Research Tools Matter More Than Ever

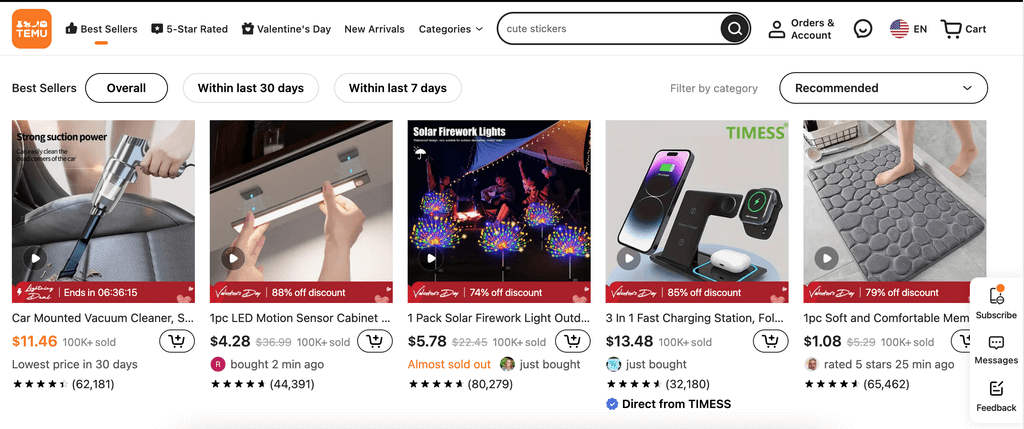

Manual research can only take you so far.

Modern product research tools allow you to:

-

Scan millions of data points

-

Identify hidden demand clusters

-

Compare competition density across categories

-

Analyze search intent and behavior shifts

-

Detect underserved micro-markets

The key is not which tool you use—but how you use it.

Step 1: Think in Verticals, Not Individual Products

One of the biggest mindset shifts in niche discovery is moving from product-first thinking to vertical-first thinking.

Instead of asking:

“What product should I sell?”

Ask:

“Which vertical market has the weakest competition relative to demand?”

A vertical market includes:

-

A specific audience

-

A shared context or lifestyle

-

Multiple related products

-

Long-term demand potential

Winning sellers don’t sell one product.

They own a vertical.

Step 2: Use Search Data to Identify Underserved Demand

Search data is the backbone of niche discovery.

Why?

Because people search when they have intent.

When analyzing search data in product research tools, don’t just look at:

-

Monthly search volume

Instead, focus on:

-

Long-tail keyword growth

-

Question-based queries

-

Problem-oriented phrases

-

Modifiers like “best,” “safe,” “for kids,” “for small spaces”

A niche often reveals itself through how people search, not how much.

Low competition niches often have:

-

Fragmented keyword sets

-

Poorly optimized listings

-

Generic products ranking for specific needs

Step 3: Measure Competition the Right Way

Most tools show competition—but few explain it.

Competition is not just:

-

Number of listings

-

Ad density

-

Brand presence

Real competition analysis includes:

-

Listing quality

-

Review relevance

-

Brand differentiation

-

Price-to-value gaps

-

Messaging clarity

A niche with 50 competitors can be easier than one with 5 strong brands.

The goal is not to avoid competition—but to find weak competition.

Step 4: Look for “Ignored Users” Inside Big Markets

Some of the best niches exist inside massive categories.

These are users who:

-

Have specific constraints

-

Are poorly served by mainstream products

-

Are forced to compromise

Examples include:

-

People with limited space

-

Users with safety concerns

-

Niche professions or hobbies

-

Caregivers, parents, pet owners

-

Aging populations

Product research tools help surface these segments by:

-

Analyzing review complaints

-

Tracking search modifiers

-

Identifying repeated unmet needs

This is where large markets quietly fracture into profitable verticals.

Step 5: Validate with Behavior, Not Just Numbers

Volume tells you how many.

Behavior tells you how serious.

Use tools that show:

-

Click-through rates

-

Conversion proxies

-

Time-on-page or engagement

-

Repeat purchase patterns

-

Seasonal consistency

A niche market with moderate volume but high intent often outperforms a high-volume, low-intent market.

Serious buyers leave clearer data trails.

The 5 Least Competitive Vertical Markets (How to Find Them)

Rather than handing you a static list that will be outdated tomorrow, let’s break down five types of vertical markets that consistently show low competition when discovered early, and how tools help identify them.

1. Functional Upgrades for Everyday Products

These niches emerge when users want:

-

Better performance

-

Added safety

-

Increased comfort

-

Longer lifespan

But existing products are:

-

Generic

-

Outdated

-

Designed for mass appeal

Using product tools, look for:

-

Reviews asking for “one small improvement”

-

Search queries with “improved,” “better,” or “version”

-

Complaints repeated across brands

These verticals often have:

-

High willingness to pay

-

Low brand loyalty

-

Minimal innovation from incumbents

2. Environment-Specific Solutions

Products designed for specific environments are often overlooked.

Examples of environments:

-

Small apartments

-

RVs or vans

-

Humid climates

-

Extreme heat or cold

-

Shared living spaces

Search tools reveal these niches through:

-

Location-based modifiers

-

Climate-related keywords

-

Use-case phrasing

Competition stays low because big brands design for averages—not extremes.

3. Safety-Driven Subcategories

Safety creates niches because it changes decision-making.

Users become:

-

Less price-sensitive

-

More research-oriented

-

Loyal to trusted solutions

Product research tools surface safety niches by:

-

Tracking keywords like “safe,” “non-toxic,” “childproof”

-

Analyzing parent or caregiver reviews

-

Identifying compliance-driven searches

These verticals often have:

-

Fewer sellers willing to meet standards

-

Higher barriers to entry

-

Longer product lifecycles

4. Maintenance and Support Products

Everyone wants the main product.

Few want to sell what keeps it working.

Maintenance niches include:

-

Cleaning

-

Storage

-

Replacement parts

-

Accessories

-

Optimization tools

These markets are:

-

Less glamorous

-

Less advertised

-

Less competitive

But product tools reveal strong signals through:

-

Repeat purchase data

-

Search consistency

-

Low ad saturation

Maintenance niches quietly generate predictable revenue.

5. Lifestyle-Triggered Micro-Markets

Lifestyle changes create demand before brands notice.

Examples:

-

Remote work

-

Aging in place

-

Pet humanization

-

Minimalism

-

Outdoor living

Tools help detect these shifts by:

-

Cross-category keyword growth

-

Content engagement patterns

-

Social-to-search lag analysis

These niches are powerful because they’re structural, not trendy.

How to Rank Niche Opportunities with Data

Once you identify potential verticals, rank them using:

-

Demand stability

-

Competition weakness

-

Differentiation potential

-

Supply chain feasibility

-

Expansion opportunities

The best niche is not the biggest—it’s the most expandable.

Turning a Niche into a Brand

The real goal of niche discovery isn’t just sales.

It’s:

-

Authority

-

Trust

-

Repeat customers

-

Defensible positioning

A niche lets you:

-

Speak directly to users

-

Design better products

-

Build content that converts

-

Scale without fighting giants

That’s something no “winning product” list can give you.

Common Niche Research Mistakes

-

Chasing zero competition

-

Ignoring long-term demand

-

Over-trusting single metrics

-

Entering niches you don’t understand

-

Failing to validate before scaling

Tools don’t replace judgment—they sharpen it.

Final Thoughts: Niche Markets Are Found, Not Invented

Niche markets already exist.

They show up in:

-

Search behavior

-

User frustration

-

Unanswered questions

-

Repeated compromises

Product research tools don’t magically reveal them.

They help you see what others ignore.

The sellers who win aren’t louder.

They’re earlier—and more focused.

And in a crowded world, focus is the ultimate advantage.

8 min read

8 min read