In the early days of ecommerce, most sellers focused on one market.

Usually the U.S.

Maybe Europe.

But today?

The real growth — and the real margins — are happening elsewhere.

Southeast Asia and Latin America are no longer “emerging.”

They are expanding at a pace that many Western markets simply can’t match.

And yet, most sellers are still competing in overcrowded marketplaces while ignoring high-profit product opportunities abroad.

Global product sourcing is no longer optional.

It’s a competitive advantage.

In this guide, you’ll learn how to:

-

Identify profitable products in Southeast Asia

-

Spot fast-growing ecommerce trends in Latin America

-

Use international product research tools effectively

-

Analyze consumer behavior differences

-

Build a cross-border ecommerce strategy with high margins

Let’s break it down.

Why Southeast Asia and Latin America Are Goldmines for Ecommerce Sellers

Before diving into tools and tactics, we need to understand why these regions matter.

Southeast Asia Ecommerce Market Growth

Countries like:

-

Indonesia

-

Vietnam

-

Thailand

-

Philippines

-

Malaysia

have seen explosive ecommerce adoption in the last five years.

Key drivers include:

-

Rapid smartphone penetration

-

Young, digital-first population

-

Expanding middle class

-

Increased cross-border shopping

In many of these countries, ecommerce growth rates exceed 15–20% annually.

Competition?

Still relatively fragmented.

That means opportunity.

Latin America Ecommerce Trends

Latin America, especially:

-

Brazil

-

Mexico

-

Colombia

-

Chile

is undergoing a digital commerce transformation.

Mobile-first shopping behavior dominates.

Social commerce is strong.

Local payment solutions are expanding access.

And importantly:

Many product categories remain under-saturated compared to U.S. markets.

That’s where high profit dropshipping products can emerge.

The Biggest Mistake in Global Product Sourcing

Most sellers make one critical mistake:

They copy U.S. bestsellers and try to sell them internationally.

That rarely works.

Why?

Because:

-

Climate differs

-

Income levels vary

-

Cultural preferences shift

-

Logistics impact pricing

-

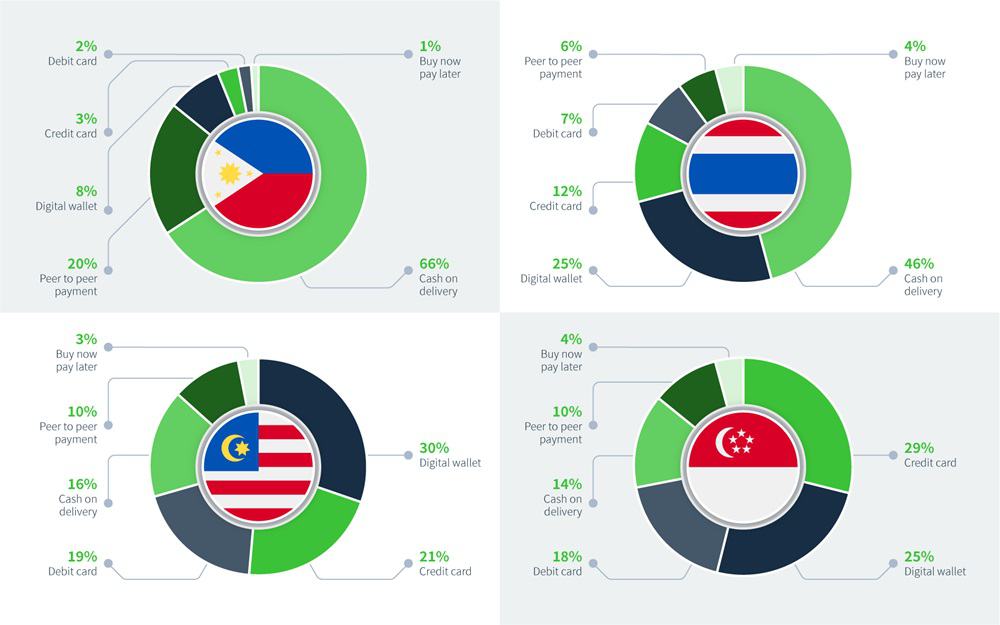

Payment systems change buying behavior

Global product sourcing requires localization.

And localization starts with data.

Step 1: Use International Product Research Tools Correctly

To discover profitable products in Southeast Asia or Latin America, you need region-specific data.

Here’s how to approach it.

1. Google Trends (Country-Specific Filtering)

Set the location filter to:

-

Indonesia

-

Vietnam

-

Brazil

-

Mexico

Search product keywords and track:

-

Seasonal spikes

-

Long-term upward trends

-

Sudden breakout terms

Look for products that:

-

Show consistent growth

-

Have low saturation in local ecommerce marketplaces

2. Marketplace Intelligence Platforms

Use regional ecommerce platforms like:

Southeast Asia:

-

Shopee

-

Lazada

Latin America:

-

Mercado Libre

-

Amazon Brazil

-

Magazine Luiza

Analyze:

-

Best-selling rankings

-

Review counts

-

Pricing gaps

-

Shipping origin

If a product has:

-

High demand

-

Limited local competition

-

Wide price variance

You may have found a margin opportunity.

3. Social Commerce Monitoring

In both Southeast Asia and Latin America, social media drives product discovery.

Monitor:

-

TikTok trending products

-

Instagram Shop activity

-

Facebook Marketplace engagement

-

Influencer product mentions

Many viral products appear on social platforms before reaching major marketplaces.

Early detection = higher margins.

Step 2: Identify Structural Margin Advantages

High profit products are not just about demand.

They’re about structural economics.

Here’s what to analyze:

Shipping Cost-to-Value Ratio

Lightweight, compact items win.

Examples:

-

Beauty tools

-

Fitness accessories

-

Home gadgets

-

Phone accessories

If shipping represents less than 15–20% of retail price, margin potential increases significantly.

Local Supply Gaps

Ask:

Is this product widely manufactured locally?

If not, cross-border sellers gain pricing power.

For example:

-

Specialty kitchen gadgets

-

Pet accessories

-

Niche hobby items

-

Smart home add-ons

Many emerging markets have strong consumer demand but limited specialized manufacturing.

Climate-Based Demand

Southeast Asia:

-

Tropical climate

-

High humidity

-

Frequent rainfall

Latin America:

-

Diverse climates

-

Urban heat

-

Coastal lifestyle

Climate-specific products often perform extremely well:

-

Portable fans

-

Moisture-resistant organizers

-

Outdoor lifestyle accessories

-

Anti-mold home solutions

Understanding environmental context creates high-profit opportunities.

Step 3: Analyze Cultural Buying Behavior

A product that sells well in the U.S. may fail in Vietnam.

Why?

Cultural perception matters.

Southeast Asia Consumer Behavior

-

Strong price sensitivity

-

High mobile usage

-

Preference for cash-on-delivery (in some areas)

-

Strong community reviews influence

Affordable lifestyle upgrades perform well.

Mid-ticket luxury may struggle.

Latin America Consumer Behavior

-

Brand perception is important

-

Social proof drives conversion

-

Installment payment options influence pricing strategy

-

Localized language marketing is critical

Products with aspirational appeal often outperform purely functional ones.

Step 4: Use Data to Predict 2026 Trends Early

Instead of chasing current bestsellers, focus on emerging signals.

Look for:

-

Search growth over 6–12 months

-

Increasing influencer mentions

-

Expanding SKU variations

-

Gradual price stabilization

Products at this stage typically offer:

-

Lower advertising costs

-

Less competition

-

Higher markup flexibility

That’s where true high profit dropshipping products exist.

Step 5: Validate Profitability with Simple Math

Before launching globally, calculate:

Product cost

-

Shipping

-

Duties (if applicable)

-

Payment processing

-

Marketing cost

Target:

Minimum 3x landed cost markup.

For emerging markets, aim for:

50–65% gross margin.

Why?

Because international logistics variability demands cushion.

5 High-Potential Product Categories in Southeast Asia & Latin America

Based on market patterns, these verticals show strong potential:

1. Affordable Smart Home Accessories

Not full systems — but add-ons.

Examples:

-

Motion sensor lights

-

Smart plugs

-

Mini security cameras

Growing urbanization supports this demand.

2. Portable Cooling Solutions

Especially in Southeast Asia.

Examples:

-

Rechargeable mini fans

-

Cooling towels

-

UV sun-protection gear

Hot climates drive consistent demand.

3. Beauty Tech Tools

Both regions show strong beauty industry growth.

Examples:

-

LED skincare masks

-

Facial cleansing brushes

-

Nail curing lamps

Compact and high perceived value.

4. Fitness Accessories

Home fitness remains strong.

Examples:

-

Resistance bands

-

Smart jump ropes

-

Massage guns

Lightweight = strong margins.

5. Pet Accessories

Pet ownership is increasing in urban areas.

Examples:

-

Grooming kits

-

Smart feeders

-

Pet cooling mats

Often under-served categories.

Logistics Strategy for Cross-Border Ecommerce

Global product sourcing only works if logistics are optimized.

Options include:

-

Local warehouse fulfillment

-

3PL partnerships

-

Hybrid shipping models

-

Regional fulfillment hubs

Faster delivery improves trust.

Trust increases repeat purchases.

Repeat purchases increase lifetime value.

Pricing Strategy for Emerging Markets

Don’t blindly apply U.S. pricing.

Consider:

-

Local purchasing power

-

Currency volatility

-

Competitor positioning

-

Psychological pricing differences

In many Latin American markets, installment-friendly pricing improves conversion significantly.

SEO Strategy for International Product Pages

If targeting Southeast Asia or Latin America via Shopify or standalone stores:

Use:

-

Country-specific keywords

-

Local language translations

-

Region-specific landing pages

-

Local currency display

-

Structured data markup

Example keyword optimization:

Instead of:

“Best portable fan”

Use:

“Best portable fan in Indonesia”

“Rechargeable mini fan Brazil”

Local intent increases ranking potential.

Risk Management in Global Ecommerce

International expansion carries risk.

Mitigate by:

-

Testing small batches

-

Using regional ad targeting

-

Monitoring currency trends

-

Tracking customs regulations

-

Building local partnerships

Start lean.

Scale data-backed winners.

The Future of Global Product Sourcing

By 2026 and beyond:

-

AI-driven product research tools will localize demand signals automatically

-

Cross-border logistics will become faster

-

Regional marketplaces will expand internationally

-

Consumers will expect global product access

The sellers who learn to read emerging market data today will dominate tomorrow.

Final Thoughts: The Margin Is in the Market Gap

High-profit ecommerce is no longer about fighting in saturated U.S. categories.

It’s about:

Finding underserved demand.

Entering before competition spikes.

Using data instead of guesswork.

Understanding cultural nuance.

Optimizing logistics intelligently.

Southeast Asia and Latin America are not “secondary markets.”

They are high-growth, margin-rich opportunities waiting for strategic sellers.

Global product sourcing is not about going everywhere.

It’s about going where the competition isn’t.

And with the right tools, the right research process, and the right validation framework…

The next breakout product might not be in your home market at all.

It might be 8,000 miles away — waiting for you to find it first.

8 min read

8 min read