In the fast-moving world of dropshipping, product research isn’t just a step in building your business—it is your business. Trends shift faster, competitors emerge quicker, and consumer attention windows are narrower than ever. If you want to survive and thrive in 2026 as an independent store owner, you need a data-driven edge.

The right tool can mean:

-

spotting a trend before it peaks

-

validating demand without guesswork

-

knowing competitor strategies without manual digging

-

choosing products that convert, not just look cool

In this comprehensive deep dive, we’ll evaluate the Top 10 Dropshipping Product Research Tools that every independent store owner should know in 2026. We’ll look at what they do, how they compare, and—most importantly—when you should use each one in your workflow.

Section 1 — Why Product Research Tools Matter More Than Ever in 2026

Before we evaluate tools, let’s lay the context.

1.1 Market Complexity Has Increased

Global commerce is no longer limited by geography. AI-powered ad platforms, fast delivery expectations, and niche community culture mean products can rise and fall in weeks.

No tool = no way to see signals early.

1.2 DIY Research Is No Longer Enough

Manual scraping of social posts, browser digging, and guesswork are outdated. The volume of data today—social trend signals, search intent, pricing history—demands automation.

1.3 Quality, Not Quantity

Good tools don’t just show lots of products—they help you identify viable ones: validated demand, reasonable competition, scalable margins.

Section 2 — What Makes a Great Dropshipping Product Tool?

Not all tools are equal. Here’s the evaluation framework used in this review:

🔹 Demand Discovery

Does the tool show real customer interest? Search trends? Social buzz? Keyword intent?

🔹 Competitive Insight

Can you gauge saturation, pricing, and competitor adoption?

🔹 Forecasting & Trend Signals

Does it project future demand, or only historical data?

🔹 Product Validation Metrics

Reviews, ratings, pricing elasticity, seasonality?

🔹 Workflow Integration

API availability, CSV export, Shopify/AliExpress/WooCommerce integration?

Section 3 — Top 10 Tools for Dropshipping Product Selection in 2026

Below is a detailed review of each tool, including strengths, limitations, unique features, and ideal use cases.

1. Jungle Scout

📍 Best for: Market validation + competitor intelligence

Overview:

Originally a powerhouse for Amazon sellers, Jungle Scout has expanded toward multi-channel research, giving indies rich data on trending products, demand, and competitor strategies.

Key Features:

-

Product Opportunity Score

-

Historical demand & seasonal trends

-

Competitive density and pricing analytics

-

Review tracking over time

Why It’s Useful:

Great for validating product categories before testing ads. Especially powerful if you plan to sell on or compete with Amazon channels.

Limitations:

Not tailored specifically for AliExpress or TikTok trends.

Best For:

Dropshippers who want confidence before testing — especially higher-ticket or brandable items.

2. Sell The Trend (STT)

📍 Best for: Trend spotting + social commerce signals

Overview:

Sell The Trend combines marketplace data with social signal analysis from TikTok, Instagram, and YouTube to identify rising product demand before it hits saturation.

Key Features:

-

Real-time social trend capture

-

Viral video performance metrics

-

Niche store ideas and funnels

-

Supplier matching engine

Why It’s Useful:

Its social engine helps you see what people are already buying or talking about—a major advantage over search-only tools.

Limitations:

Some features require premium tiers, and data can be noisy if not filtered properly.

Best For:

Indies relying on paid social ads or influencer marketing.

3. Niche Scraper

📍 Best for: Store & competitor scraping

Overview:

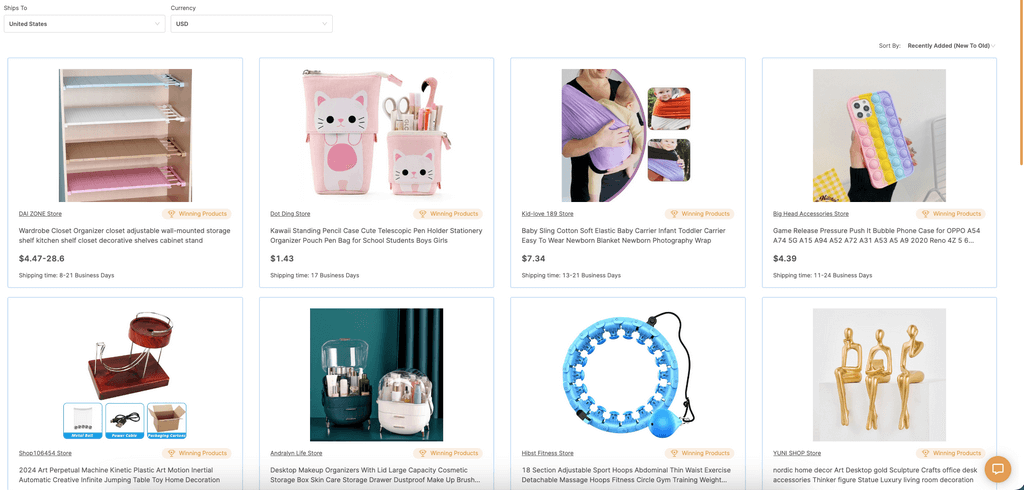

Niche Scraper pulls product, pricing, and sales estimate data from existing stores, revealing what’s already selling and where store owners are focusing.

Key Features:

-

Store product scraping

-

Autogenerated product lists

-

Engagement analytics

Why It’s Useful:

Instead of guessing winners, this tool shows what real stores are selling—especially useful for benchmarking and price strategy.

Limitations:

Sales estimates are rough; complementary validation is recommended.

Best For:

Quick competitor analysis and pricing strategy planning.

4. Google Trends

📍 Best for: Macro trend validation (free)

Overview:

No tool is more foundational for demand trends than Google Trends. It doesn’t show sales—but it shows search interest over time.

Key Features:

-

Demand curves

-

Geographic heat maps

-

Related keyword insights

Why It’s Useful:

Trends help you avoid short-lived fads and plan products with climbing or stable interest.

Limitations:

Lacks detail like pricing or sales volume.

Best For:

Early stage validation and seasonality checks.

5. Exploding Topics

📍 Best for: Emerging trend discovery

Overview:

Exploding Topics finds trending products or topics before they go mainstream by analyzing search behavior and content patterns.

Key Features:

-

Early signal detection

-

Cross-industry trend mapping

-

Backed by search and social data

Why It’s Useful:

Great for first-mover discovery—especially if you plan to niche-dominate.

Limitations:

Requires interpretation; trends don’t always convert directly to products.

Best For:

Independent sellers with a content or branding angle.

6. AliExpress Dropshipping Center (ADC)

📍 Best for: Supplier product insights

Overview:

Built into AliExpress, this tool shows product popularity, order history, and related metrics that matter for dropshipping.

Key Features:

-

Hot product rankings

-

Search performance indicators

-

Related product suggestions

Why It’s Useful:

Direct data from a major supplier marketplace means better insight into actual buy behavior.

Limitations:

Only covers AliExpress ecosystem.

Best For:

Sellers sourcing primarily from AliExpress.

7. Pexda (if Active in 2026)

📍 Best for: Curated viral product suggestions

Overview:

Pexda uses proprietary algorithms to spot trending products early and suggests angles, creatives, and market angles.

Key Features:

-

Suggests ad angles & hooks

-

Trending signal scores

-

Creative inspiration

Why It’s Useful:

Tells you not just what to sell, but how to pitch it.

Limitations:

Some over-reliance on templated angles; requires creative adaptation.

Best For:

Ads-driven sellers and media buyers.

8. Trend Hunter

📍 Best for: Innovation and product ideation

Overview:

More of a macro trend platform, Trend Hunter helps you spot emerging consumer behaviors that can inform product ideas.

Key Features:

-

Culture insights

-

Niche trend reports

-

Innovation patterns

Why It’s Useful:

Very helpful for building brandable product lines that sit ahead of micro-trends.

Limitations:

Not sales or marketplace-specific.

Best For:

Brand-focused merchants looking to create deeper narratives.

9. TikTok Creative Center & TikTok Pulse Data

📍 Best for: Short-form trend signals and commercial content analytics

Overview:

TikTok’s official data tools show you trending sounds, challenge engagements, and product/commerce signals tied to video performance.

Key Features:

-

Trend rising charts

-

Engagement benchmarks

-

Category signals

-

Demographic breakdowns

Why It’s Useful:

Social commerce is central in 2026—being able to tie trend data to buying intent is extremely powerful.

Limitations:

Doesn’t show direct sales; interpretation is critical.

Best For:

Social-first stores and creative teams.

10. Keyword & SEO Tools (Ahrefs, SEMrush, Ubersuggest)

📍 Best for: Organic demand and keyword validation

Overview:

No product research stack is complete without strong keyword tools to validate intent-based searches that convert.

Key Use Cases:

-

Monthly search volume

-

Competitive keyword difficulty

-

Long-tail product opportunity discovery

Why It’s Useful:

Paid ads can die with a policy change—organic search trends are durable demand signals.

Limitations:

Requires SEO competency.

Best For:

Merchants building blogs, comparison pages, and long-term traffic funnels.

Section 4 — How to Use These Tools in a Strategic Workflow

Knowing tools is one thing—using them strategically is another.

Here’s a recommended 3-phase flow:

🔎 Phase 1: Discovery (Exploding Topics + TikTok Data + Google Trends)

Purpose: Spot rising signals before saturation.

📊 Phase 2: Validation (Jungle Scout + ADC + SEO Tools)

Purpose: Confirm real demand, search intent, and volume.

🔎 Phase 3: Competitive Edge (STT + Niche Scraper + Pexda + SEO Keywords)

Purpose: Understand competitor positioning, pricing, creatives, and angles.

Pair trends with research before investing in ads or inventory.

Section 5 — Common Mistakes in Tool-Based Product Selection

❌ Mistake 1: Chasing Popularity Without Validation

Trend alone ≠ sales.

❌ Mistake 2: Ignoring Seasonality

Always check patterns over multiple years when possible.

❌ Mistake 3: Over-reliance on One Tool

No single data source paints the full picture.

❌ Mistake 4: Skipping Competitor Analysis

You must understand pricing and saturation before scaling.

Section 6 — How to Evaluate Tools for Your Business

Ask these questions:

✅ Does this tool match my product sourcing channels?

✅ Does it show intent, or just popularity?

✅ How fresh is the data (real-time vs delayed)?

✅ Can it integrate with store platforms (Shopify, Woo, etc.)?

✅ Does it help with pricing and competition insights?

A tool that helps answer one of these questions is useful. A tool that answers all of them becomes strategic.

Section 7 — Budgeting and Prioritizing Tools in 2026

Not every store needs every tool.

Starter Tier (Budget Friendly)

-

Google Trends

-

TikTok Creative Center

-

Ubersuggest / Free SEO tools

-

AliExpress Dropshipping Center

Growth Tier (Paid but Actionable)

-

Sell The Trend (STT)

-

Niche Scraper

-

Keyword tools (Ahrefs / SEMrush)

-

Trend Hunter

Pro Tier (Data + Creative Integration)

-

Jungle Scout

-

TikTok Pulse Data

-

Pexda/paid trend engines

Invest based on business stage, budget, and revenue goals—not buzz.

Section 8 — Real Merchants, Real Results: Case Examples

Example 1: $0 → $30K with Trend-First, Data-Backed Product Discovery

Merchant used Exploding Topics + TikTok trends to identify niche outdoor gear two weeks before saturation and validated demand with SEO tools before launch.

Example 2: Seasonal Timing Wins

By combining seasonal signals from Google Trends with competitor pricing from ADC, a holiday decor store scheduled launches months ahead, reducing ad costs by 40%.

Example 3: Creative Angle Discovery

Using Sell The Trend + TikTok Creative Center, a kitchen accessories seller found ad copy patterns that outperformed generic creatives by 25%.

Conclusion — 2026’s Competitive Edge Is Not Guesswork, It’s Data + Strategy

In 2026, dropshipping success isn’t random. It’s the result of:

✔ spotting rising demand early

✔ validating real shopper intent

✔ understanding competitor signals

✔ integrating trend insights with execution

Tools alone don’t create winners—smart workflows do. The tools above give you the information foundation; your strategy turns that information into revenue.

If you’re serious about building a sustainable independent store—not just chasing viral products—then having the right research stack is no longer optional.

It’s your competitive moat.

10 min read

10 min read