When you get them right, they can generate explosive sales in a short period of time, boost cash flow, and bring in waves of new customers.

When you get them wrong, you’re left with dead inventory, rushed discounts, and the sinking feeling that you were this close—but still too late.

Most sellers don’t fail at seasonal products because they choose the wrong items.

They fail because they start too late.

In this guide, we’ll break down how experienced sellers use product research tools to plan seasonal winners three months ahead, avoid common traps, and turn predictable calendar events into repeatable revenue.

This is not about guessing trends.

It’s about building a system.

Why Seasonal Products Feel So Risky (and Why They Don’t Have to Be)

Ask most eCommerce sellers about seasonal products and you’ll hear the same fears:

-

“What if demand doesn’t materialize?”

-

“What if I miss the peak?”

-

“What if everyone else sells the same thing?”

-

“What if I’m stuck with inventory?”

These fears are valid—but they’re also symptoms of poor timing, not bad strategy.

Seasonal demand is actually one of the most predictable forces in eCommerce. Holidays don’t move. School seasons repeat. Weather patterns follow cycles. Gift-buying behavior is surprisingly consistent year after year.

The real challenge isn’t uncertainty.

It’s preparation.

And preparation starts earlier than most sellers think.

The 3-Month Rule: Why Timing Is Everything

One of the biggest misconceptions about seasonal selling is when the “season” actually begins.

Let’s take a common example: Christmas.

Most new sellers think:

“Christmas products sell in December.”

Experienced sellers know:

-

Research starts in September

-

Listings and creatives are ready by October

-

Ads and traffic warm up in early November

-

Peak sales often happen before Christmas week

By the time consumers are actively buying, the groundwork must already be done.

This is why the 3-month rule matters.

If you start researching seasonal products when everyone is already searching for them, you’re not early—you’re competing at the most expensive moment.

Seasonal Selling Is Not About One Product

Another mistake sellers make is treating seasonal success as a single-product gamble.

In reality, strong seasonal strategies focus on:

-

Product themes

-

Customer use cases

-

Bundles and variations

-

Angle differentiation

Your goal is not to “find the next viral product.”

Your goal is to own a slice of seasonal intent.

Tools help with this—but only if you use them correctly.

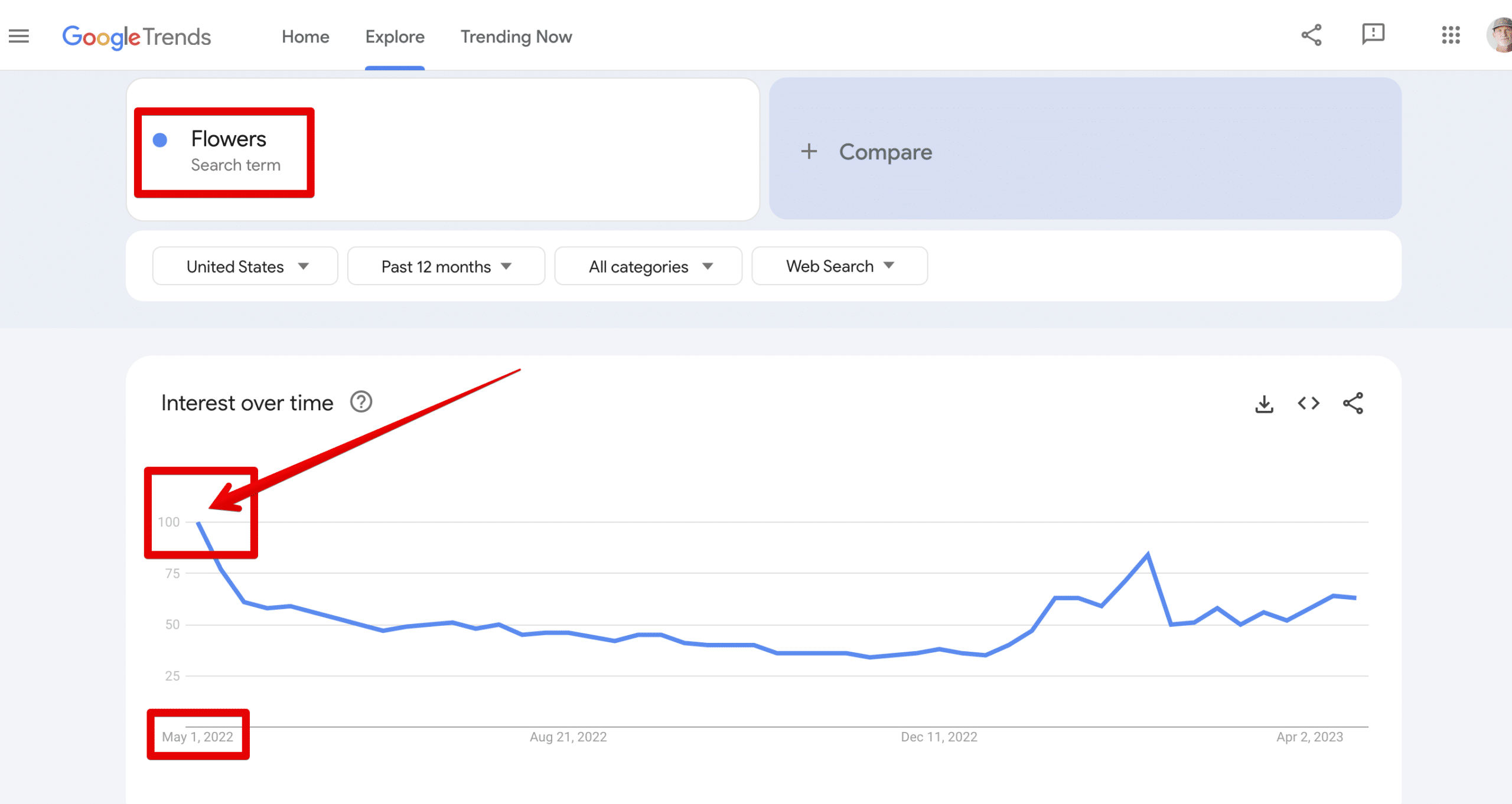

Step 1: Identify Seasonal Demand Before It Spikes

Use Historical Data, Not Current Hype

Most product research tools allow you to view:

-

Year-over-year sales

-

Search volume history

-

Trend curves

-

Seasonal patterns

Instead of filtering for “hot” or “trending,” look for products that show:

-

Repeated spikes at the same time each year

-

Gradual buildup rather than sudden explosions

-

Stable off-season baselines

These signals indicate planned buying behavior, not impulse hype.

For example:

-

Halloween decorations

-

Back-to-school organizers

-

Summer outdoor gear

-

Valentine’s Day gifts

-

Holiday home décor

The exact products may change, but the categories remain consistent.

Zoom Out: Categories First, Products Second

A common mistake is starting with individual SKUs.

A smarter approach:

-

Identify seasonal categories

-

Break them into sub-categories

-

Then analyze specific products

For instance, instead of chasing a single Christmas item, look at:

-

Home décor

-

Giftable accessories

-

Party supplies

-

Family activities

-

Personalization opportunities

This gives you flexibility—and backup options if one product underperforms.

Step 2: Validate Demand Without Overreacting to Competition

High Competition Is Not Always a Red Flag

Seasonal products almost always look competitive—because demand concentrates into short windows.

What matters is not how many sellers exist, but:

-

How differentiated the listings are

-

Whether customers complain about the same issues

-

If sellers are racing to the bottom on price

-

Whether branding is weak or generic

Your tools can show you surface-level competition.

Customer reviews tell you where the opportunity is.

Mine Reviews for Seasonal-Specific Pain Points

Seasonal buyers behave differently from regular buyers.

They care about:

-

Delivery timing

-

Packaging quality

-

Ease of use

-

Gift presentation

-

Reliability under time pressure

Look for reviews that mention:

-

“Arrived too late”

-

“Didn’t look like the photos”

-

“Hard to set up”

-

“Not suitable as a gift”

-

“Broke during the holiday”

Each complaint is a chance to improve—or reposition.

Step 3: Forecast, Don’t Guess

Use Tools to Build Demand Scenarios

Advanced sellers don’t rely on a single forecast.

They build scenarios.

Using historical data, estimate:

-

Conservative demand

-

Expected demand

-

Aggressive demand

Then plan inventory, ads, and cash flow accordingly.

The goal is not to sell out perfectly.

It’s to avoid being:

-

Out of stock too early

-

Overstocked after the season ends

Seasonal selling rewards discipline, not optimism.

Plan Exit Strategies Before You Launch

One sign of a mature seasonal seller is this:

They know how they’ll exit before they enter.

Ask yourself:

-

Can this product be repurposed off-season?

-

Can it be bundled later?

-

Can it be discounted without killing margins?

-

Can it transition into evergreen use?

Tools help you see off-season demand patterns.

Use that data to reduce risk upfront.

Step 4: Prepare Listings and Creatives Early

Algorithms Reward Early Momentum

Marketplaces and ad platforms favor:

-

Stable conversion data

-

Historical performance

-

Engagement consistency

If you launch at peak season with zero history, you’re paying the highest price for traffic with the weakest signals.

Instead:

-

Launch listings quietly

-

Gather early reviews

-

Test creatives

-

Refine messaging

By the time peak demand arrives, you’re not “new.”

You’re ready.

Seasonal Messaging Is Not Just Keywords

Seasonal buyers are emotionally driven.

Your content should reflect:

-

Urgency

-

Occasion relevance

-

Social context

-

Gifting intent

This goes far beyond inserting holiday keywords.

Think in terms of:

-

Who is buying?

-

Who is receiving?

-

When will it be used?

-

What problem does it solve during that season?

Tools can show you search terms—but context sells.

Step 5: Don’t Compete on Price—Compete on Timing and Clarity

Late sellers fight on price.

Early sellers win on positioning.

When you prepare three months ahead, you can:

-

Price for margin, not desperation

-

Communicate clearly

-

Control inventory pacing

-

Scale ads gradually

This is where tools truly shine—not as shortcuts, but as early warning systems.

Common Seasonal Product Mistakes (and How to Avoid Them)

Starting Research Too Late

If you see everyone talking about a product, you’re already behind.

Treating Seasonal as One-Time Opportunities

Seasonality repeats. Systems compound.

Overcommitting Inventory

Seasonal demand is sharp—but short.

Ignoring Post-Season Data

Your biggest insights come after the season ends.

Turning Seasonal Wins Into Long-Term Growth

The best seasonal sellers don’t just make money once.

They:

-

Capture customer emails

-

Retarget buyers next season

-

Expand into related categories

-

Build brand association with events

Seasonal products are not side projects.

They’re entry points.

When executed correctly, they fuel long-term growth—not short-term chaos.

Final Thoughts

Seasonal selling doesn’t reward speed.

It rewards foresight.

Product research tools won’t magically hand you holiday bestsellers—but they can give you a powerful advantage if you use them early, thoughtfully, and strategically.

Plan three months ahead.

Think in categories, not just products.

Read customers, not just charts.

And remember: the season starts long before the calendar says it does.

That’s how seasonal products stop feeling risky—and start becoming predictable.

8 min read

8 min read