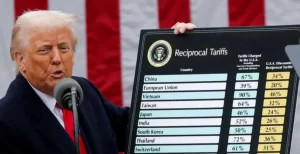

In April 2025, U.S. President Donald Trump announced a series of tariff policies dubbed “Liberation Day.” He claimed these tariffs would boost American manufacturing, protect jobs, and imposed additional duties on goods imported from dozens of so-called “worst offenders,” raising tariffs on Chinese products to as high as 125%.

At the same time, these measures are having a profound impact on businesses operating on platforms like Shopify and on the broader cross-border e-commerce landscape.

The steep rise in import costs has fundamentally reshaped the e-commerce environment, forcing sellers to embark on a quest for new supply chain solutions. In the following sections, we’ll dive into the latest developments and explore the far-reaching implications these changes hold for online businesses.

Tariffs: What They Are and How They Work

Simply put, tariffs are taxes you pay when buying goods from another country.

In most cases, tariffs are calculated as a percentage of the product’s value. For example, if an item is worth $10 (roughly £7.59) and the tariff rate is 25%, you’d need to pay an additional $2.50 (about £1.90) in tax.

Now, if a 125% tariff is applied to goods imported from China, that means a $10 product would incur an extra $12.50 in tax.

So who pays this tax? It’s the companies that bring foreign goods into the U.S.—the importers. They’re the ones responsible for paying the tariff to the government.

When is the tax paid? Right when the goods go through U.S. customs, the tariff has to be paid.

Of course, businesses often have their own strategies. They may choose to pass on some or all of that added cost to consumers, making shoppers ultimately bear the burden.

Overview of Tariffs

On April 2, 2025, defined by the Trump administration as “Liberation Day,” a series of wide-reaching tariff measures were officially announced:

| Tariff Policy | Effective Date | Tariff Rate | Affected Scope |

|---|---|---|---|

| Basic Import Tariff | April 5, 2025 | 10% | Covers all imported goods |

| Tariff on Chinese Goods | April 9, 2025 | Cumulative 54% | Applies to all goods imported from China |

| Import Tariff on Automobiles | April 3, 2025 | 25% | Applies to all non-U.S. manufactured vehicles |

| Tariff on Automobile Parts | May 3, 2025 (Expected) | 25% | Applies to imported automobile parts |

| Tariff on Steel and Aluminum Products | March 12, 2025 | 25% | Applies to imported steel and aluminum products |

Impacts of Tariff Policy Changes

Trump’s announced new tariff policy has brought numerous impacts on Chinese companies expanding overseas, especially in the cross-border e-commerce sector. Among these, the cancellation of the duty-free treatment for packages valued under $800 has had a huge impact on Chinese cross-border e-commerce sellers.

Previously, this duty exemption policy helped numerous sellers offer products at lower prices, but now, even if individual item prices are not high, tariffs must be paid, which directly increases sellers’ operating costs, and consequently, consumers’ purchase costs as well.

Impact on Cross-Border E-commerce Business

Impact on E-commerce Business Costs

The latest tariff policies have had a multifaceted impact on Shopify sellers and cross-border e-commerce businesses that rely on imported goods. New tariffs have significantly increased product and shipping costs, with increases ranging from 10% to 30%, especially for goods imported from China, which now face tariffs as high as 54%. This directly compresses sellers’ profit margins. For cross-border e-commerce businesses that previously relied on duty-free imports, they are now under greater cost pressure.

Impact of Changes to Duty-Free Exemption Rules

In the past, imported goods valued under $800 were exempt from tariffs, a policy highly favorable to cross-border e-commerce. However, the new policy has removed this exemption, meaning that almost all cross-border e-commerce orders will now face tariffs, further increasing operating costs.

Logistics and Customs Issues

Due to stricter customs checks and documentation requirements, imported goods are facing longer processing times and potential delays. This not only affects the user experience but may also lead to increased refunds and order cancellations, bringing numerous inconveniences to cross-border e-commerce businesses.

Changes in E-commerce Market Competition

Sellers who rely on low-cost Chinese goods are facing increasingly intense competition, while the value of local suppliers is rising. This could lead to significant adjustments in market structure, presenting both challenges and opportunities for new entrants and existing sellers.

Impact on U.S. Consumers

General Price Increases

Many economists predict that businesses will pass some or all of the costs onto consumers, resulting in a general increase in the price of imported goods. Affected products may include clothing, coffee, alcohol, electronics, and more. Some businesses may also reduce imports, leading to fewer foreign goods available in the market and higher prices. Additionally, products made in the U.S. using imported parts may see price increases. For example, automotive parts often travel multiple times between the U.S., Mexico, and Canada before a complete vehicle is assembled. Analysts have pointed out that cars made using only Mexican and Canadian parts could see a price increase of $4,000 to $10,000 (approximately £3,035 to £7,588).

Tariff Policy Threatens the Economy

These tariff measures could also harm the U.S. economy. According to former IMF chief economist Ken Rogoff, after Trump announced the new tariffs, the likelihood of a recession in the U.S. rose to 50%. However, senior officials in Trump’s administration have repeatedly downplayed the risk of a recession, insisting that the tariffs will be implemented as planned.

E-commerce Businesses Response Strategies

Trump’s tariff policies have been disastrous for e-commerce businesses. However, Shopify sellers and other cross-border e-commerce companies haven’t just sat idly by. They’ve come up with various strategies to cope and minimize the impact of the tariffs, trying to keep their businesses running smoothly.

Supply Chain Optimization

Find Local U.S. Suppliers: Many sellers plan to source products from local U.S. suppliers to avoid paying import tariffs entirely. Although this might initially cost more, it can stabilize prices in the long run and increase consumer trust in product quality. Platforms like Syncee can help sellers find quality local products in the U.S.

Diversify the Supply Chain to Other Countries: Savvy sellers are diversifying their sources to countries with lower tariffs, such as Singapore, Chile, and Israel, which are not yet affected by Trump’s tariff policies. A manufacturer from Nepal on Reddit mentioned that their country has only a 10% tariff, much lower than the tariff on imports from China. Some companies have also moved their production to Southeast Asian countries like Vietnam, Thailand, or Mexico to reduce export tariffs to the U.S. However, some Southeast Asian countries have also imposed high tariffs, so this strategy may not always be effective.

Build Warehouses Overseas: Some sellers are considering setting up warehouses overseas, allowing them to ship goods in advance and save on logistics and tariffs when selling. However, building a warehouse and managing it involves significant costs and isn’t an easy task.

Expand into New Markets

Sell to Other Countries: Some sellers are no longer focusing solely on the U.S. market and are instead targeting Europe, Australia, the UAE, the Middle East, and Latin America. By diversifying into these regions, they can reduce reliance on the U.S. market. Even if U.S. policies change, they won’t lose as much and can find new opportunities to profit.

Optimize Operations Management

Adjust Pricing: Sellers can’t pass all the increased tariff costs onto consumers, so they need to rethink their pricing strategies. They can negotiate with suppliers to lower costs, manage inventory better to avoid excess stock, find cheaper shipping options, and make sure consumers understand how prices are set.

Use Software for Management: Some businesses use ERP systems to manage inventory and supply chains. For example, Shufu ERP can adjust purchasing volumes based on current conditions to reduce the risk of unsold stock. Shufu SCM and ERP systems also help businesses in the home goods industry adjust strategies and remain competitive despite tariff policies.

Optimize Website and Marketing: Sellers can improve their websites to make them more searchable on search engines, increase conversion rates, and speed up page load times, helping to minimize the negative impact of tariffs. Tenten Commerce can help Shopify sellers optimize their websites for better usability.

Switch to Selling Different Products

Sellers can also try selling more expensive, higher-margin products. Even with high tariffs, there may still be some profit room. However, this requires researching the market again, identifying who would buy the new products, and figuring out how to market them, which comes with certain risks.

Overall, e-commerce businesses need to be flexible and adjust their business models in response to policy changes. This way, they can withstand the cost pressure from tariffs and remain steady in the market.

Shein and Temu’s Supply Chain Restructuring Strategies

In April 2025, the new tariff policies came into effect, and the “minimum exemption” clause was eliminated. This hit major cross-border e-commerce companies like Shein and Temu hard, with costs rising by 30% to 50%. However, they didn’t sit idly by; each company came up with different strategies to restructure their supply chains and remain competitive in the market.

Shein’s Supply Chain Breakthrough Strategy

Shein focused on three main approaches to break through the challenges.

Firstly, it spread out its production bases. Shein targeted Vietnam and turned it into a key production hub. To encourage Chinese suppliers to shift production there, Shein offered a 30% increase in procurement prices. The company plans to move 40% of its production to Vietnam, where its new smart factory in Hanoi is particularly impressive, completing production to shipment in just 72 hours. Additionally, Shein set up a European fast-response center in Istanbul, Turkey, and a warehouse in São Paulo, Brazil, allowing quicker access to the South American market. The shipping time from these locations to the U.S. East Coast was reduced to just 7 days.

Next, Shein worked on minimizing tariffs. By using Singapore and Chile as transit points, Shein re-labeled Chinese products as “ASEAN-made” to benefit from lower 10% tariffs. It also broke down items worth over $800 into multiple packages for customs declaration and used an AI-driven pricing system to avoid the single-item tariff.

Finally, Shein made local arrangements in the U.S. It adopted a “bonded warehouse” model in its warehouses in Chicago and Los Angeles, where it stored 3 million different products in advance. This allowed shipments to reach customers in just three days, with the warehouse inventory turning over up to eight times a year.

Temu’s Supply Chain Adjustment Tactics

Temu initially used an “all-in-one” model, heavily relying on small parcel cross-border logistics. The previous tax exemption on small parcels gave it an edge in both logistics costs and pricing. However, with the new policy changes, logistics costs spiked, and this model became less viable. Moreover, with the increased tariffs, Temu lost its competitive advantage of low prices. Previously, items on Shein and Temu were 15% to 35% cheaper than the same products sold locally in the U.S., which attracted many American consumers. But with the higher tariffs, Temu’s costs also rose, and to compensate, it had to raise product prices, reducing the price advantage.

To address these challenges, Temu started heavily promoting its semi-managed model. In fact, it launched this model in March 2024, and after Trump took office, it accelerated the transition from “all-in-one” to “semi-managed.” Temu also introduced a “one-click transfer” feature, allowing sellers to move their best-selling products from fully managed stores to semi-managed ones, transferring sales and reviews along with them. These strategies are helping Temu adjust its supply chain and business model to navigate the current difficulties.

| Model | Launch Time | Category | Target Merchants | Pricing Authority | Logistics & Warehousing | Advertising |

|---|---|---|---|---|---|---|

| Full Hosted | September 2022 | / | Chinese merchants, with preference for source factories | Platform sets sales price and approves supplier pricing | Platform handles logistics; merchants ship to domestic warehouses | Platform manages ad traffic and determines allocation |

| Semi-Hosted | March 2024 | Cross-border | Chinese-registered companies with overseas warehouses, local delivery capabilities, and stocked inventory | Platform sets sales price and approves supplier pricing | Merchant self-shipping | Platform manages ad traffic and determines allocation |

| Semi-Hosted | Around June 2024 | Local | Overseas local companies with overseas warehouses, local delivery capabilities, and stocked inventory | Platform sets sales price and approves supplier pricing | Merchant self-shipping | Platform manages ad traffic and determines allocation |

Summary and Suggestions

Trump’s April 2025 tariff policy has brought significant challenges to you Shopify sellers and cross-border e-commerce businesses, but it has also created new opportunities. The successful sellers will be those who can adapt quickly. You not only need to focus on cost control but also on supply chain flexibility, product differentiation, and customer experience. The following suggestions may help you maintain competitiveness in the new tariff environment:

1. Actively explore local supply options, especially for sellers targeting the U.S. market.

2. Reevaluate your product portfolio, which may require shifting to higher-margin products or locally manufactured goods.

3. Maintain flexibility in your pricing strategy, finding a balance to stay competitive while maintaining profit.

4. Invest in website optimization and customer experience to increase the value of each visitor.

5. Keep a close eye on policy changes, as tariff conditions may change with political and economic developments.

No matter whether you’re a new seller or have already established your presence in the market, this policy change highlights that opportunities always favor those who can quickly adjust their strategies.

Contents

Toggle

14 min read

14 min read